COMPANY NEWS

FY 2019 Profit-After-Tax Up 30.9% to HK$302.5 million,was up 36.5% in RMB denomination

2020.03.17

Download

Hong Kong, 17 March 2020

Essex Bio-Technology Limited (“EssexBio” or the “Group”—Stock Code: 1061) is pleased to announce that the Group has achieved significant progression and encouraging performances in the financial year ended 31 December 2019.

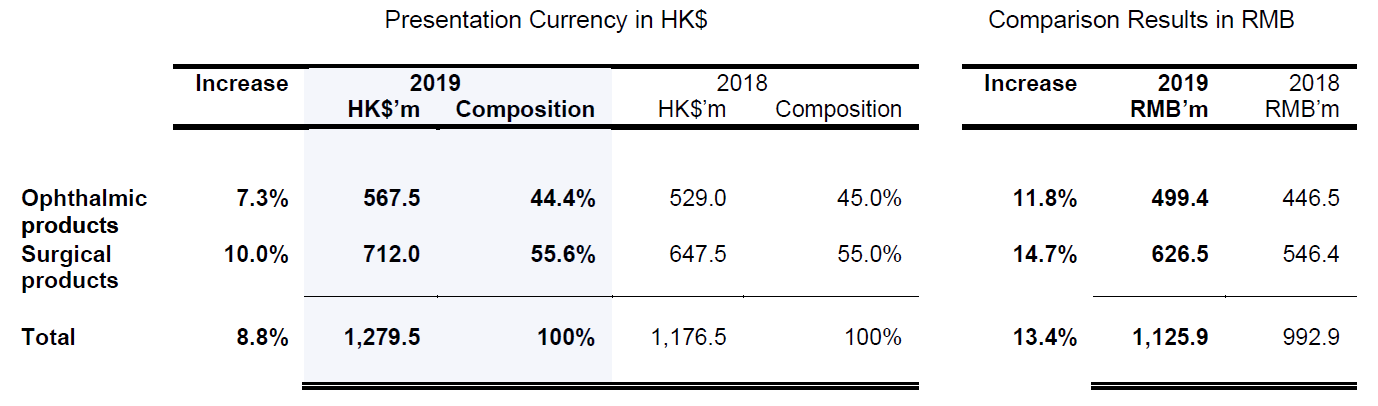

For the year ended 31 December 2019, the Group achieved a consolidated turnover of approximately HK$1,279.5 million, representing an increase of 8.8% (the increase is 13.4% as compared to the result in RMB denomination) over the last year. Whereas, the Group’s consolidated profits for the year rose to approximately HK$302.5 million from approximately HK$231.1 million for the last year, representing an increase of 30.9% (the increase is 36.5% as compared to the results in RMB denomination), despite the major medical and pharmaceutical industry-related policy and regulatory changes to drive overall healthcare costs down in recent years.

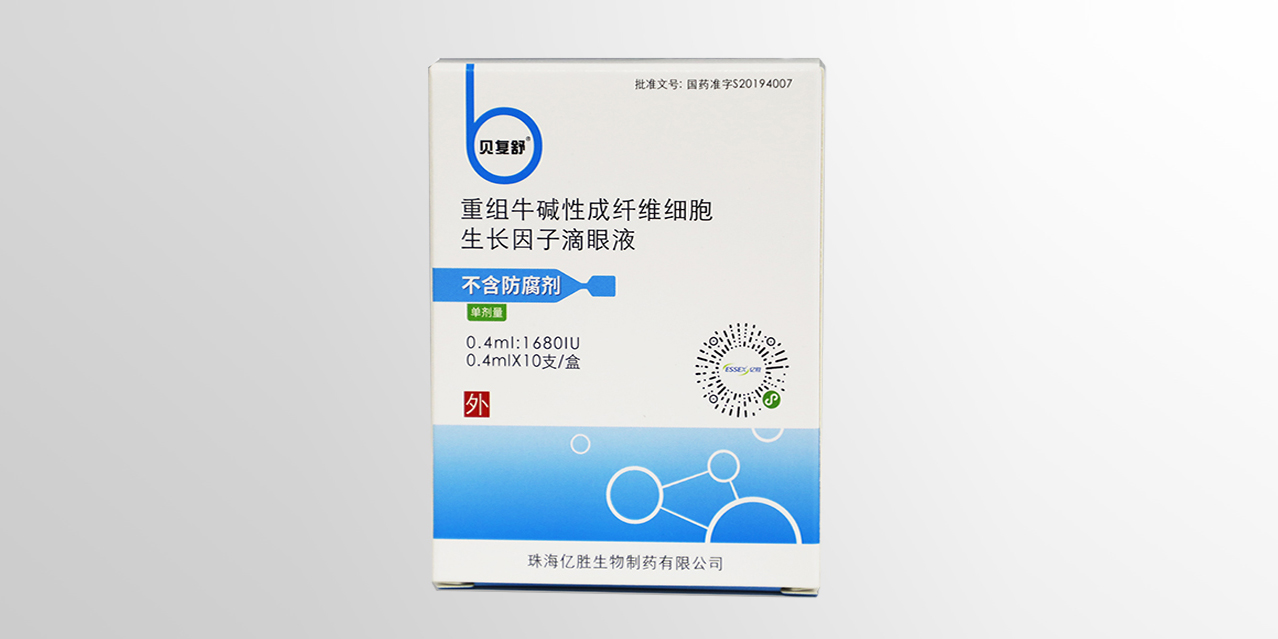

Turnover from the Group’s two flagship product series – Beifushu series for ocular surface treatment and Beifuji series for surface wounds healing and treatment (collectively referred to as the “bFGF Series”), accounted for 24.7% and 54.5% of the Group’s total turnover, respectively. The turnover of the bFGF Series represented 79.2% of the Group’s total turnover for the year ended 31 December 2019. Turnover from the Group’s third party products, inclusive of Xalatan® Eye Drops, Xalacom® Eye Drops, 适丽顺 (Iodized Lecithin Capsules) and 伊血安颗粒 (Yi Xue An Granules), collectively accounted for 20.2% of the Group’s total turnover.

The sectoral business of the Group is organised under:

Essex Bio-Technology Limited (“EssexBio” or the “Group”—Stock Code: 1061) is pleased to announce that the Group has achieved significant progression and encouraging performances in the financial year ended 31 December 2019.

For the year ended 31 December 2019, the Group achieved a consolidated turnover of approximately HK$1,279.5 million, representing an increase of 8.8% (the increase is 13.4% as compared to the result in RMB denomination) over the last year. Whereas, the Group’s consolidated profits for the year rose to approximately HK$302.5 million from approximately HK$231.1 million for the last year, representing an increase of 30.9% (the increase is 36.5% as compared to the results in RMB denomination), despite the major medical and pharmaceutical industry-related policy and regulatory changes to drive overall healthcare costs down in recent years.

Turnover from the Group’s two flagship product series – Beifushu series for ocular surface treatment and Beifuji series for surface wounds healing and treatment (collectively referred to as the “bFGF Series”), accounted for 24.7% and 54.5% of the Group’s total turnover, respectively. The turnover of the bFGF Series represented 79.2% of the Group’s total turnover for the year ended 31 December 2019. Turnover from the Group’s third party products, inclusive of Xalatan® Eye Drops, Xalacom® Eye Drops, 适丽顺 (Iodized Lecithin Capsules) and 伊血安颗粒 (Yi Xue An Granules), collectively accounted for 20.2% of the Group’s total turnover.

The sectoral business of the Group is organised under:

- Ophthalmology – Beifushu series and third party ophthalmic products include Xalatan® Eye Drops, Xalacom® Eye Drops and 适丽顺 (Iodized Lecithin Capsules); and

- Surgical – Beifuji series and third party surgical products include 伊血安颗粒 (Yi Xue An Granules)

The sectoral turnover of Ophthalmology and Surgical is approximately represented by 44.4% and 55.6% of the Group’s turnover, respectively.

Composition of turnover for the years ended 31 December 2019 and 2018, respectively, is shown in the following table:

- The increase in turnover from the overall ophthalmic products was attributable to the turnover growth of 43.5% from third party products, but was weighed down by a decrease of 11.0% in turnover from Beifushu series. The decrease was due to prudent decision taken to guard against such unfavourable trading conditions resulted from regulatory and policy changes in recent years.

- The increase in turnover from the overall surgical products was mainly attributable to the turnover growth of 10.9% from the Group’s Beifuji series.

The positive result is a testament to its resilience to changes in external operating conditions. To achieve a sustainable traction in ongoing growth amid recent significant regulatory changes on how drugs are priced and prescribed, the Group initiated the following sales and marketing strategies and tactics during the year under review:

- Investing in clinical observation programmes for affirming additional clinical indications of its commercialised products;

- Reaching out to market in lower-tier cities;

- Cultivating pharmaceutical stores, where possible, as complementary sales channel; and

- Building on-line platform for medical consultation and e-prescription for patients with chronic diseases under its healthtech initiative.

During the year under review, the Group’s pharmaceutical products are being prescribed in around 8,600 hospitals and medical organisations, coupled with approximately 2,000 pharmaceutical stores

in the PRC, which are directly managed by 43 regional sales offices with around 1,300 sales and marketing representatives.

In 2019, operationally the Group has achieved a few new milestones and development values, namely:

In 2019, operationally the Group has achieved a few new milestones and development values, namely:

- Granted with the approval for registration and commercialisation of preservative-free single-dose Beifushu Eye Drops in the PRC;

- One of the bFGF Series, Beifuxin gel, has been listed on the National Drug List for Basic Medical Insurance, Work-Related Injury Insurance and Maternity Insurance (the “NDL”) issued by the National Healthcare Security Administration and the Ministry of Human Resources and Social Security of the PRC since 20 August 2019. The other three products of the bFGF Series remain listed on the NDL;

- Honourably awarded the second prize of the National Scientific and Technology Progress Award for its accomplishment in key technical breakthrough, theory innovation, and industrialisation of the cellular growth factor drugs in the PRC; and

- Included by Morgan Stanley Capital International (the “MSCI”) as a constituent of the MSCI China Small Cap Index with effect from 28 May 2019.

For the near-term expansion of the Group, construction work of the second factory of the Group has started on 1 January 2020 and is expected to be completed by mid 2023. The second factory with a GFA of about 58,000 square metres is planned to house the Group’s R&D centre, additional manufacturing facility, administrative office and staff hostel.

To advance our pursuits of new therapeutics programme involving antibodies that, in particular, target in oncology and ophthalmology, a wholly owned subsidiary, EssexBio Therapeutics Inc. has been incorporated in the United States ( “EssexBio USA” ) on 9 March 2020. EssexBio USA is set up as the Group’s R&D centre and will undertake clinical trial management of the Group’s products in the United States. Being in the United States, EssexBio USA will position the Group with better visibility for in and out licensing potential of technologies and products.

Under the Enrichment Programme, which was initiated since 2015, up to the date of results announcement, the Group has invested totalling approximately HK$ 432.2 million in projects and/or companies that are at different clinical stages of development of therapeutics particularly in the fields of ophthalmology and oncology, and in healthtech for therapy.

During the year under review, the Group has further invested in the followings:

Ophthalmology

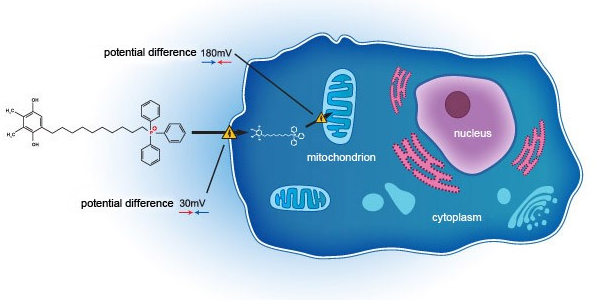

The Group had entered into a co-development agreement with Mitotech S.A. and Mitotech LLC on 16 July 2018. Under the agreement, as at the date of results announcement, the Group invested approximately US$17.3 million for the first phase 3 clinical trial (“the First P3 Trial”) of SkQ1 in U.S.FDA. The results of the First P3 Trial have shown positive and encouraging topline data with clinically relevant signs and symptoms in respect of efficacy and safety.

Considering the development milestones are satisfactorily achieved in respect of the SkQ1 in the First P3 Trial in U.S.FDA, on 10 December 2019, the Group exercised the option to fund the second phase 3 clinical trial (the “Second P3 Trial”) of the SkQ1 up to a maximum of US$20.0 million. The first patient first visit in the Second P3 Trial has commenced in December 2019. The Second P3 Trial was originally scheduled for completion by Q2 2020, but would be delayed to Q3 2020 due to the disruption from the pandemic of novel coronavirus (COVID-19). As at the date of results announcement, the Group invested approximately US$6.1 million for the Second P3 Trial.

Oncology

The Group entered into a series of investment agreements (including a convertible loan agreement, a subscription and shareholders deed, and shares subscription) and a licence agreement with Antikor Biopharma Limited (“Antikor”) during the year under review. Antikor is an early stage biotechnology company incorporated and registered in England and Wales, focusing on the development of miniaturised antibody fragment drug conjugates (“FDCs”) for cancer therapy. As at the date of results announcement, total investment in Antikor is approximately US$1.6 million (equivalent to approximately HK$12.5 million).

Healthtech

In the healthtech arena, the Group invested in Chengdu Shanggong Medical Technology Co., Ltd. (“Shanggong”) which was the first step into the therapy business. Following the acquisition of around 8% of equity interests in Shanggong in 2018, on 6 December 2019, the Group further entered into a convertible loan agreement with Shanggong to make available a convertible loan in the principal amount of RMB15.0 million to Shanggong for a term of 12 months, interest-bearing at a rate of 10% per annum. The conversion of the principal amount of the convertible loan into such number of shares, together with the equity interests acquired in 2018, will represent approximately 15.38% of the enlarged and fully diluted share capital of Shanggong. As at the date of results announcement, the Group has not converted any of the principal amount of the convertible loan into shares of Shanggong.

As at the date of results announcement, the outbreak of the COVID-19 has been declared as a pandemic by WHO. If the outbreak remains protracted, our performances would be negatively impacted, including the Group’s R&D projects and ongoing clinical trial programmes would be

delayed. The Board will continue to assess the impact of the outbreak on the Group’s operation and financial performance and closely monitor the Group’s exposure to the risks and uncertainties in connection with the outbreak.

The Group had cash and cash equivalents of approximately HK$473.3 million as at 31 December 2019. To further reward our valued shareholders, the Board is pleased to propose a final dividend of HK$0.05 per ordinary share (in addition to the interim dividend of HK$0.035 paid in September 2019) to be approved at the upcoming annual general meeting of the Company.

粤公网安备 44049102496184号

粤公网安备 44049102496184号