COMPANY NEWS

Group Turnover and Profit in the First Half of 2018 Increased 28.3%

2018.08.10

Download

Hong Kong, 8 August 2018

Essex Bio-Technology Limited (“EssexBio” or the “Group”—Stock Code: 1061) is pleased to announce that for the six months ended 30 June 2018, the Group achieved a consolidated turnover of approximately HK$561.3 million (the “Group Turnover”), representing a growth rate of 28.3%, with profit after tax for the period under review increased to approximately HK$98.9million, representing an increase of 28.3% as compared to the same period last year.

HK$440.3 million or 78.4% of the Group Turnover was mainly derived from the Group’s flagship bio-pharmaceutical products, Beifushu and Beifuji Series, which represented an increase of 26.1% and HK$121.0 million or 21.6% of the Group Turnover was generated from the sale of third party products (inclusive of Xalacom eye drops and Xalatan eye drops of Pfizer (for Ophthalmology), Iodized Lecithin Capsules (for Ophthalmology), Yi Xue An Granules (for Obstetrics & Gynaecology) and Carisolv Products (for Stomatology)., which recorded an increase of 36.9% as compared to the corresponding period of last year.

Combining the Group’s flagship bio-pharmaceutical and third party products, the Group’s turnover contributed from the ophthalmology and surgical segments is represented as 47.9% and 52.1%, respectively.

Driven by the strong sales of third party ophthalmology products (including Pfizer’s products and lodized Lecithin Capsules), the revenue of overall ophthalmology products contributed approximately HK$268.6 million to the Group’s turnover for the period under review, representing a growth of 24.6%. Similarly Beifuji series, as the core product of surgical segment, maintained a strong growth momentum in the first half of 2018, which recorded a growth of 41.8%, resulting in the overall surgical product achieved a total revenue of approximately HK$292.7 million for the period under review, representing an increase of 31.8% as compared to the corresponding period of last year.

During the period under review, the Group has obtained another preservative-free single-dose eye drop, Levofloxacin, approval from State Drug Administration (the “SDA”) for registration and commercialisation. Levofloxacin eye drop is used to treat blepharitis, hordeolum, dacryocystitis, conjunctivitis, tarsadenitis and keratitis, and for aseptic treatment during the perioperative period of ocular surgery. The first preservative-free single-dose eye drop of the Group, Tobramycin, was approved in April 2017.

During the period under review and in July, the Group made its maiden investments into big-data, medical analytics (AI Algorithm) in medical service industry arena. The investments are:

1. On 21 May 2018, Essex Bio-Investment entered into a convertible loan agreement with Global Health and its shareholder, pursuant to which Essex Bio-Investment agreed to make available a convertible loan in the principal amount of SG$2.0 million (equivalent to approximately HK$11.8 million) in three tranches to Global Health at an interest rate of 2.5% per annum for a term of 5 years and an internal rate of return of 6% if no conversion has been taken place before the maturity date. The first tranche of the convertible loan in the principal amount of SG$1.0 million (equivalent to approximately HK$5.9 million) was disbursed to Global Health on 1 June 2018.

The conversion of the principal amount of the convertible loan into such number of shares will represent 40% of the enlarged total issued share capital of Global Health. As at the date of this report, Essex Bio-Investment has not converted any of the principal amounts of the convertible loan into shares of Global Health.

Global Health, a Singapore company incorporated in September 2015, operates a Software as a Service (SaaS) cloud-based intelligent, scalable clinics management and digital medical records system. The system developed by Global Health provides accurate, up-to-date and actionable data to enable physicians, clinics and individuals to make the best outcome for patients’ treatment and operational efficiency of clinics. The investment in Global Health will lead the Group into the Southeast Asia healthcare market via Singapore.

2. As disclosed in the announcement of the Group dated 18 July 2018, (i) 成都上工医信科技有限公司(Chengdu Shanggong Medical Technology Co.,Ltd.)(“Chengdu Shanggong”); (ii) 珠海亿胜科技发展有限公司 (Zhuhai Essex Technology Development Company Limited*) ("Zhuhai Essex Tech"), an indirect wholly-owned subsidiary of the Group; and (iii) 9 other independent third parties, entered into an investment agreement on 18 July 2018, pursuant to which, among other things, Zhuhai Essex Tech shall make an investment in cash in the amount of RMB20.0 million (equivalent to approximately HK$23.4 million) as capital contribution in Chengdu Shanggong, which will increase the registered capital, and the capital reserve, of Chengdu Shanggong (the "Investment"). Upon completion of the Investment, Zhuhai Essex Tech will hold 8% of equity interests in Chengdu Shanggong.

Chengdu Shanggong is a medical data analytics (AI Algorithm) company in the medical service industry in the PRC, having fully curated, quality controlled approximately 700,000 retinal images of diabetic patients in the PRC, which forms a retinopathy big data that enables AI Algorithm to perform its diagnosis. The AI Algorithm can screen retinal images of patients and detect diabetic retinopathy, which affects almost a third of diabetes patients that would otherwise be examined by highly trained ophthalmologists.

The Investment is a strategic consideration that is to enhance the Group’s market positioning in the ophthalmology business and Chengdu Shanggong can leverage on the Group’s about 1,400 sales force for penetrating into more hospitals of its AI Algorithm.

The Group has cash and cash equivalent of approximately HK$ 308.4 million as at 30 June 2018 (31 December 2017: approximately HK$ 240.6 million).

The board of Directors (“the Board”) is pleased to declare an interim dividend of HK$0.03 (For the six months ended 30 June 2017: HK$0.025) per ordinary share for the six months ended 30 June 2018.

Events After the Reporting Period

1. On 16 July 2018, Essex Bio-Investment Limited ("Essex Bio-Investment"), a direct wholly-owned subsidiary of the Group, entered into a co-development agreement with Mitotech S.A. ("Mitotech") and Mitotech LLC under which Essex Bio-Investment has agreed to fund to a maximum of approximately US$16.5 million (equivalent to approximately HK$129.7 million), for a clinical development in the United States Food and Drug Administration first phase 3 clinical trial of the product (the "Product"), being an ophthalmic solution containing SkQ1 as its sole active pharmaceutical ingredient which shall be provided as a pharmaceutical product in the field of dry eye disease, in return for a share of certain income received by Mitotech in respect of the Product in accordance with the agreed percentage allocation between Essex Bio-Investment and Mitotech. Please refer to the announcement of the Group dated 16 July 2018 for details.

2. On 18 July 2018, 珠海亿胜生物制药有限公司 (Zhuhai Essex Bio-Pharmaceutical Company Limited*) ("Zhuhai Essex"), an indirect wholly-owned subsidiary of the Group, entered into a licence agreement with Mitotech, pursuant to which Mitotech agreed to grant to Zhuhai Essex an exclusive and royalty-bearing licence of the necessary intellectual property rights for, among others, undertaking development, manufacturing, marketing and commercialising of the Product in Singapore and the PRC (including Hong Kong, Macau and Taiwan). Zhuhai Essex shall pay Mitotech royalties on aggregate net sales of the Product labelled for treatment of uveitis and dry eye disease at a royalty rate of 6.5% and 5.5%, respectively.

3. On 18 July 2018, Zhuhai Essex successfully tendered for one plot of state-owned land in Zhuhai, the PRC (the "Land") at a total consideration of approximately RMB9.6 million (equivalent to approximately HK$11.2 million) for the purpose of the construction of a production plant on the Land and the Land Use Rights Transfer Contract has been entered into between The Land and Resources Bureau of Zhuhai and Zhuhai Essex on 18 July 2018. Therefore, the investment agreement entered into between Zhuhai Essex and 珠海(国家)高新技术产业开发区管理委员会 (Zhuhai National High-Tech Industrial Development Zone Management Committee*) dated 29 June 2018 (the "Investment Agreement") shall take effect and the construction of the production plant will proceed as contemplated under the Investment Agreement. The capital expenditure in connection with the design and construction of the production plant on the Land are estimated to be approximately RMB227.6 million (equivalent to approximately HK$266.3 million). Please refer to the announcements of the Group dated 29 June 2018 and 18 July 2018 for details.

Essex Bio-Technology Limited (“EssexBio” or the “Group”—Stock Code: 1061) is pleased to announce that for the six months ended 30 June 2018, the Group achieved a consolidated turnover of approximately HK$561.3 million (the “Group Turnover”), representing a growth rate of 28.3%, with profit after tax for the period under review increased to approximately HK$98.9million, representing an increase of 28.3% as compared to the same period last year.

HK$440.3 million or 78.4% of the Group Turnover was mainly derived from the Group’s flagship bio-pharmaceutical products, Beifushu and Beifuji Series, which represented an increase of 26.1% and HK$121.0 million or 21.6% of the Group Turnover was generated from the sale of third party products (inclusive of Xalacom eye drops and Xalatan eye drops of Pfizer (for Ophthalmology), Iodized Lecithin Capsules (for Ophthalmology), Yi Xue An Granules (for Obstetrics & Gynaecology) and Carisolv Products (for Stomatology)., which recorded an increase of 36.9% as compared to the corresponding period of last year.

Combining the Group’s flagship bio-pharmaceutical and third party products, the Group’s turnover contributed from the ophthalmology and surgical segments is represented as 47.9% and 52.1%, respectively.

Driven by the strong sales of third party ophthalmology products (including Pfizer’s products and lodized Lecithin Capsules), the revenue of overall ophthalmology products contributed approximately HK$268.6 million to the Group’s turnover for the period under review, representing a growth of 24.6%. Similarly Beifuji series, as the core product of surgical segment, maintained a strong growth momentum in the first half of 2018, which recorded a growth of 41.8%, resulting in the overall surgical product achieved a total revenue of approximately HK$292.7 million for the period under review, representing an increase of 31.8% as compared to the corresponding period of last year.

During the period under review, the Group has obtained another preservative-free single-dose eye drop, Levofloxacin, approval from State Drug Administration (the “SDA”) for registration and commercialisation. Levofloxacin eye drop is used to treat blepharitis, hordeolum, dacryocystitis, conjunctivitis, tarsadenitis and keratitis, and for aseptic treatment during the perioperative period of ocular surgery. The first preservative-free single-dose eye drop of the Group, Tobramycin, was approved in April 2017.

During the period under review and in July, the Group made its maiden investments into big-data, medical analytics (AI Algorithm) in medical service industry arena. The investments are:

1. On 21 May 2018, Essex Bio-Investment entered into a convertible loan agreement with Global Health and its shareholder, pursuant to which Essex Bio-Investment agreed to make available a convertible loan in the principal amount of SG$2.0 million (equivalent to approximately HK$11.8 million) in three tranches to Global Health at an interest rate of 2.5% per annum for a term of 5 years and an internal rate of return of 6% if no conversion has been taken place before the maturity date. The first tranche of the convertible loan in the principal amount of SG$1.0 million (equivalent to approximately HK$5.9 million) was disbursed to Global Health on 1 June 2018.

The conversion of the principal amount of the convertible loan into such number of shares will represent 40% of the enlarged total issued share capital of Global Health. As at the date of this report, Essex Bio-Investment has not converted any of the principal amounts of the convertible loan into shares of Global Health.

Global Health, a Singapore company incorporated in September 2015, operates a Software as a Service (SaaS) cloud-based intelligent, scalable clinics management and digital medical records system. The system developed by Global Health provides accurate, up-to-date and actionable data to enable physicians, clinics and individuals to make the best outcome for patients’ treatment and operational efficiency of clinics. The investment in Global Health will lead the Group into the Southeast Asia healthcare market via Singapore.

2. As disclosed in the announcement of the Group dated 18 July 2018, (i) 成都上工医信科技有限公司(Chengdu Shanggong Medical Technology Co.,Ltd.)(“Chengdu Shanggong”); (ii) 珠海亿胜科技发展有限公司 (Zhuhai Essex Technology Development Company Limited*) ("Zhuhai Essex Tech"), an indirect wholly-owned subsidiary of the Group; and (iii) 9 other independent third parties, entered into an investment agreement on 18 July 2018, pursuant to which, among other things, Zhuhai Essex Tech shall make an investment in cash in the amount of RMB20.0 million (equivalent to approximately HK$23.4 million) as capital contribution in Chengdu Shanggong, which will increase the registered capital, and the capital reserve, of Chengdu Shanggong (the "Investment"). Upon completion of the Investment, Zhuhai Essex Tech will hold 8% of equity interests in Chengdu Shanggong.

Chengdu Shanggong is a medical data analytics (AI Algorithm) company in the medical service industry in the PRC, having fully curated, quality controlled approximately 700,000 retinal images of diabetic patients in the PRC, which forms a retinopathy big data that enables AI Algorithm to perform its diagnosis. The AI Algorithm can screen retinal images of patients and detect diabetic retinopathy, which affects almost a third of diabetes patients that would otherwise be examined by highly trained ophthalmologists.

The Investment is a strategic consideration that is to enhance the Group’s market positioning in the ophthalmology business and Chengdu Shanggong can leverage on the Group’s about 1,400 sales force for penetrating into more hospitals of its AI Algorithm.

The Group has cash and cash equivalent of approximately HK$ 308.4 million as at 30 June 2018 (31 December 2017: approximately HK$ 240.6 million).

The board of Directors (“the Board”) is pleased to declare an interim dividend of HK$0.03 (For the six months ended 30 June 2017: HK$0.025) per ordinary share for the six months ended 30 June 2018.

Events After the Reporting Period

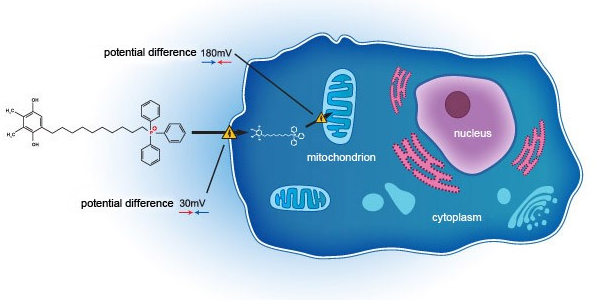

1. On 16 July 2018, Essex Bio-Investment Limited ("Essex Bio-Investment"), a direct wholly-owned subsidiary of the Group, entered into a co-development agreement with Mitotech S.A. ("Mitotech") and Mitotech LLC under which Essex Bio-Investment has agreed to fund to a maximum of approximately US$16.5 million (equivalent to approximately HK$129.7 million), for a clinical development in the United States Food and Drug Administration first phase 3 clinical trial of the product (the "Product"), being an ophthalmic solution containing SkQ1 as its sole active pharmaceutical ingredient which shall be provided as a pharmaceutical product in the field of dry eye disease, in return for a share of certain income received by Mitotech in respect of the Product in accordance with the agreed percentage allocation between Essex Bio-Investment and Mitotech. Please refer to the announcement of the Group dated 16 July 2018 for details.

2. On 18 July 2018, 珠海亿胜生物制药有限公司 (Zhuhai Essex Bio-Pharmaceutical Company Limited*) ("Zhuhai Essex"), an indirect wholly-owned subsidiary of the Group, entered into a licence agreement with Mitotech, pursuant to which Mitotech agreed to grant to Zhuhai Essex an exclusive and royalty-bearing licence of the necessary intellectual property rights for, among others, undertaking development, manufacturing, marketing and commercialising of the Product in Singapore and the PRC (including Hong Kong, Macau and Taiwan). Zhuhai Essex shall pay Mitotech royalties on aggregate net sales of the Product labelled for treatment of uveitis and dry eye disease at a royalty rate of 6.5% and 5.5%, respectively.

3. On 18 July 2018, Zhuhai Essex successfully tendered for one plot of state-owned land in Zhuhai, the PRC (the "Land") at a total consideration of approximately RMB9.6 million (equivalent to approximately HK$11.2 million) for the purpose of the construction of a production plant on the Land and the Land Use Rights Transfer Contract has been entered into between The Land and Resources Bureau of Zhuhai and Zhuhai Essex on 18 July 2018. Therefore, the investment agreement entered into between Zhuhai Essex and 珠海(国家)高新技术产业开发区管理委员会 (Zhuhai National High-Tech Industrial Development Zone Management Committee*) dated 29 June 2018 (the "Investment Agreement") shall take effect and the construction of the production plant will proceed as contemplated under the Investment Agreement. The capital expenditure in connection with the design and construction of the production plant on the Land are estimated to be approximately RMB227.6 million (equivalent to approximately HK$266.3 million). Please refer to the announcements of the Group dated 29 June 2018 and 18 July 2018 for details.

粤公网安备 44049102496184号

粤公网安备 44049102496184号