COMPANY NEWS

FY18 Turnover & Net Profit grew 30.8% and 38.1% to HK$1,176.5 million & HK$ 231.1 million, respectively

2019.03.12

Download

Hong Kong, 11 March 2019

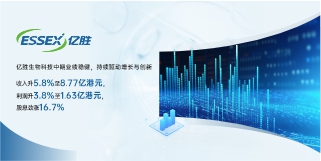

ESSEX BIO-TECHNOLOGY LIMITED (“Essex” or the “Group” or the Company)-Stock code: 1061) is pleased to announce that the Group has achieved an encouraging performance in the financial year ended 31 December 2018.

For the year ended 31 December 2018, the Group achieved a consolidated turnover of approximately HK$1,176.5 million, representing an increase of 30.8% over previous year. Correspondingly, the Group's consolidated profits for the year rose to approximately HK$231.1 million for the year ended 31 December 2018 from approximately HK$167.3 million last year, representing an increase of 38.1%.

Turnover from the Group’s two flagship product series - Beifushu series for ocular surface treatment and Beifuji series for surface wounds healing and treatment, accounted for 30.2% and 53.5% of the Group's total turnover, respectively. The combined turnover of the two product series represented 83.7% of the Group's total turnover for the year ended 31 December 2018. Turnover from the Group’s third party products, inclusive of Xalatan® Eye Drops, Xalacom® Eye Drops, Iodized Lecithin Capsules and Yi Xue An Granules, collectively accounted for 16.3% of the Group’s total turnover.

Combining the Group's flagship biopharmaceutical products and third party products, the overall turnover contributed from the ophthalmology and surgical segments is represented as 45.0% and 55.0%, respectively.

The Group's gross profit has grown in tandem with growing sales. The gross profit for the year ended 31 December 2018 was approximately HK$973.5 million (2017: approximately HK$737.6 million), representing an increase of 32.0%.

The resilient performance is the positive outcome from significant changes made by the Group to its sales and marketing organisation and strategies to enable its products to

ESSEX BIO-TECHNOLOGY LIMITED (“Essex” or the “Group” or the Company)-Stock code: 1061) is pleased to announce that the Group has achieved an encouraging performance in the financial year ended 31 December 2018.

For the year ended 31 December 2018, the Group achieved a consolidated turnover of approximately HK$1,176.5 million, representing an increase of 30.8% over previous year. Correspondingly, the Group's consolidated profits for the year rose to approximately HK$231.1 million for the year ended 31 December 2018 from approximately HK$167.3 million last year, representing an increase of 38.1%.

Turnover from the Group’s two flagship product series - Beifushu series for ocular surface treatment and Beifuji series for surface wounds healing and treatment, accounted for 30.2% and 53.5% of the Group's total turnover, respectively. The combined turnover of the two product series represented 83.7% of the Group's total turnover for the year ended 31 December 2018. Turnover from the Group’s third party products, inclusive of Xalatan® Eye Drops, Xalacom® Eye Drops, Iodized Lecithin Capsules and Yi Xue An Granules, collectively accounted for 16.3% of the Group’s total turnover.

Combining the Group's flagship biopharmaceutical products and third party products, the overall turnover contributed from the ophthalmology and surgical segments is represented as 45.0% and 55.0%, respectively.

The Group's gross profit has grown in tandem with growing sales. The gross profit for the year ended 31 December 2018 was approximately HK$973.5 million (2017: approximately HK$737.6 million), representing an increase of 32.0%.

The resilient performance is the positive outcome from significant changes made by the Group to its sales and marketing organisation and strategies to enable its products to

remain relevant with wider market reach for sustainable growth traction. The Group is investing significantly in:

- Clinical observation programmes on the drugs’ clinical indications;

- Reaching out to lower-tier cities;

- Cultivating pharmaceutical stores, where possible, as complementary sales channel;

- Upgrading our sales staff on products knowledge proficiency and professionalism; and

- Using e-channel for training and imparting knowledge purposes.

Apart from the strong financial performance in 2018, the Group achieved significant milestones in 2018, namely:

- The Group was granted with the approval for registration and commercialisation of preservative-free single-dose Sodium Hyaluronate Eye Drops and Levofloxacin Eye Drops in the People’s Republic of China (the “PRC”). It has also obtained a 藥品GMP證書 (Certificate of Good Manufacturing Practices for Pharmaceutical Products) in respect of the preservative-free single-dose Tobramycin Eye Drops in 2018.

- The Company was chosen as one of the 100 exchange-traded companies in Forbes China’s “Up-and-Comers List” in 2018 for the second consecutive year.

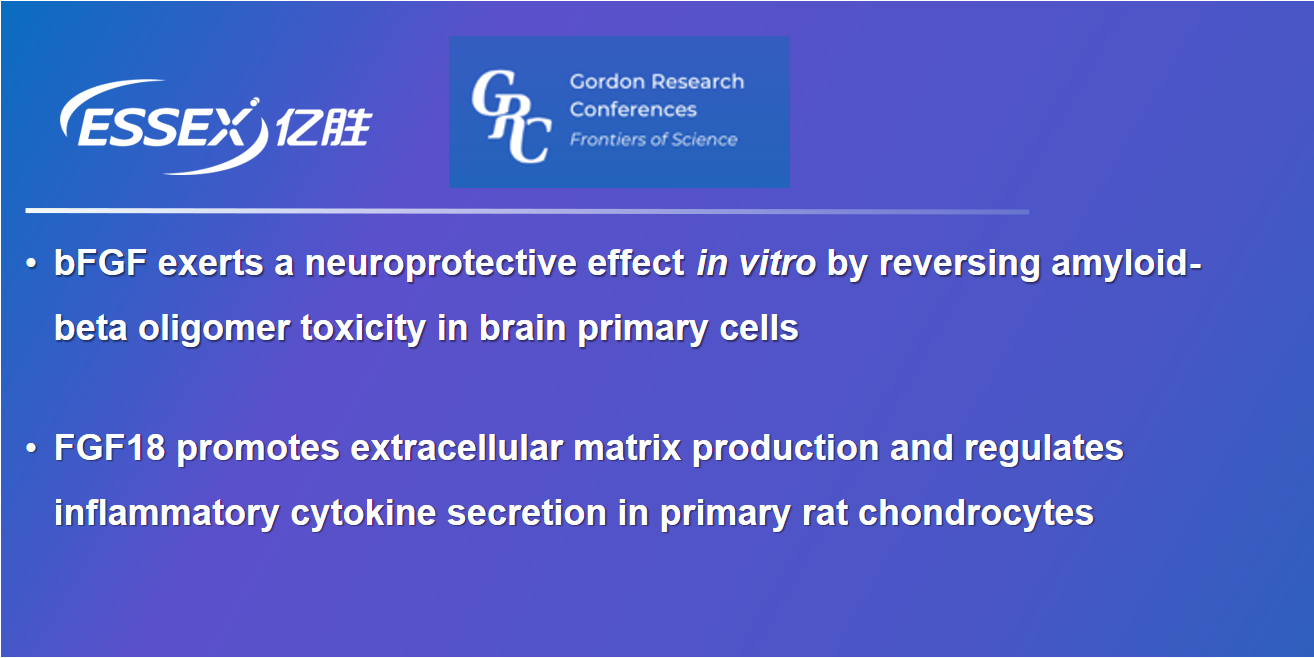

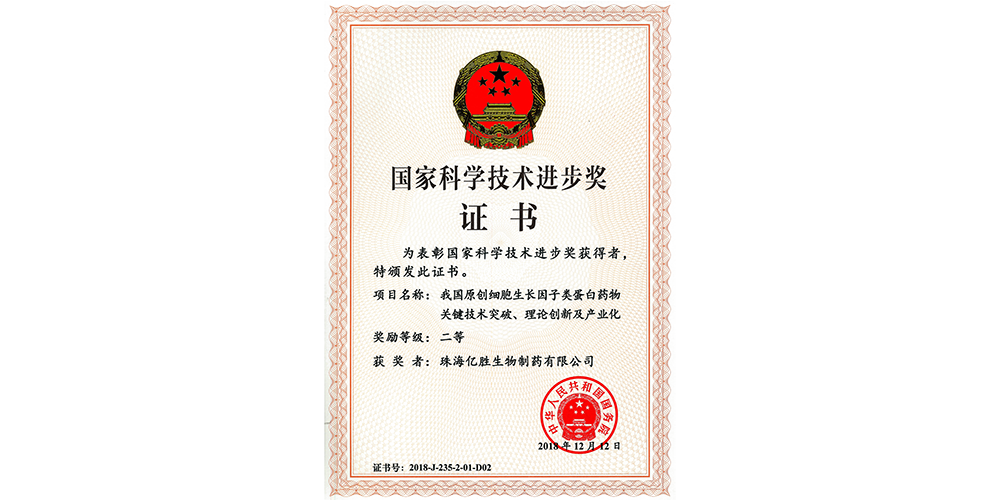

- The Company was honourably awarded the Second Prize of the National Scientific and Technology Progress Award for its accomplishment in commercialising the cellular growth factor (bFGF) project, a testament to the Group’s achievements.

As at 31 December 2018, the Group maintains 42 regional sales offices and a total number of about 1,320 sales and marketing representatives, out of which approximately 730 people are full-time staff and approximately 590 people are on contract basis or from appointed agents.

During the year under review, the Group has secured extension of the import and service agreement with Pfizer International Trading (Shanghai) Limited for Xalatan® Eye Drops and Xalacom® Eye Drops in the PRC for a further 3 years, expiring in 2021. In addition, the Group has achieved other business development and strategic investments under its Enrichment Progroamme initiated in 2015.

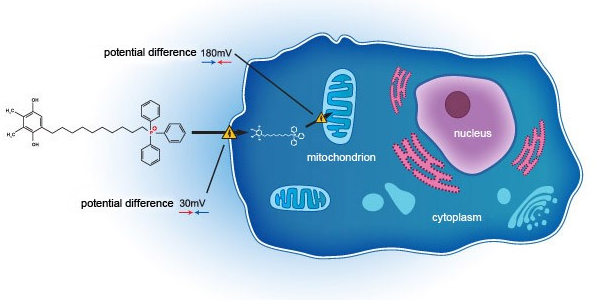

- The Group has entered into a co-development agreement with Mitotech S.A. and Mitotech LLC on 16 July 2018. Under the agreement, the Group will invest not more than US$16.5 million for a clinical development in the United States Food and Drug Administration first phase 3 clinical trial of an ophthalmic

solution containing SkQ1 as its sole active pharmaceutical ingredient, which shall be provided as a pharmaceutical product in the field of dry eye disease.

- Investment in DB Therapeutics, Inc. (“DBT”). The investment in DBT, a US company, was in the form of a series of convertible notes in an aggregate principal amount not to exceed US$4.5 million, bearing an interest rate of 5% per annum and maturing on 31 July 2022. DBT is an early stage medical device company focusing on the development of radiotherapeutic bandages for the treatment of non-melanoma skin cancer (the “DBT Product”). If successfully developed, the DBT Product will provide a convenient and cost-effective way to treat localised skin cancer in patients, as compared to surgical interventions, external beam radiation therapy and electronic brachytherapy.

- Investment in MeiraGTx Limited (“MeiraGTx”). MeiraGTx, a company incorporated and registered in England and Wales, is a clinical-stage biotech company developing novel gene therapy treatments for a wide range of inherited and acquired disorders for which there are no effective treatments available. MeiraGTx focuses on developing therapies for ocular diseases, including inherited blindness as well as Xerostomia following radiation treatment for head and neck cancers and neurodegenerative diseases such as amyotrophic lateral sclerosis. The Group invested around US$5 million in MeiraGTx to subscribe for approximately 7.7% of the enlarged issued preferred C shares. MeiraGTx was successfully listed on the NASDAQ Stock Market of the US on 8 June 2018 (Stock code: MGTX) and the preferred C shares were converted into 1.76% of the fully enlarged share capital of MeiraGTx upon listing.

- Investment in Chengdu Shanggong Medical Technology Co., Ltd. (“Shanggong”) during the year of 2018, which was the first step to develop the big data business. The Group invested an amount of RMB20 million as capital contribution in Shanggong to hold around 8% of equity interests in Shanggong. Shanggong is a medical data analytics (AI Algorithm) company in the medical service industry in China, having fully curated, quality controlled approximately 700,000 retinal images of diabetic patents in China, which forms a retinopathy big data that enables AI Algorithm to perform its diagnosis. The AI Algorithm can screen retinal images of patients and detect diabetic retinopathy, which affects almost a third of diabetes patients that would otherwise be examined by highly trained ophthalmologists. The investment in Shanggong is a strategic consideration for enhancing the Group’s market positioning in the ophthalmology business and Shanggong can leverage on the Group’s sales resources for penetrating into more hospitals of its AI Algorithm.

- To cope with the rapid expansion, the Group has acquired a piece of land of

about 15,000 square metres located at the Zhuhai Hi-Tech Industrial Park. The land is within walking distance from our existing factory. The plan is to construct the Group’s second factory with a gross floor area (GFA) of about 45,000 square metres. The 2nd factory is to house the Group’s R&D centre, additional manufacturing facility, administrative office and staff hostel. Construction work is expected to start in the fourth quarter of 2019.

The Board is pleased to propose a final dividend of HK$0.033 (2017: HK$0.025) per ordinary share to be approved at the upcoming annual general meeting of the Company to further reward its valued shareholders.

粤公网安备 44049102496184号

粤公网安备 44049102496184号