COMPANY NEWS

Essex Bio-Technology Reports 1st H 2024 Net Profit of HK$157.4 Million Poised for Future Success Underpinned by Proven Product Base and Promising Pipeline of Products

2024.08.26

Download

Hong Kong, 26 August 2024

Results Highlights:

Results Highlights:

- Net profit margin improved to 19.4% from 18.9% (2023) despite a 9.8% drop in revenue and 7.3% drop in profit to HK$811.63 million and HK$157.44 million respectively amidst challenging market conditions.

- Total assets increased by 4.9% to HK$2,965.81 million.

- Interim dividend HK$6.0 cents (2023 H1: HK$4.5 cents) per share, higher rewards to shareholders

- IFC CB Loan was fully repaid on 31 July 2024.

- Successively dosed in a phase III clinical study for HLX04-O for the treatment of wet-AMD in the PRC, Latvia, Australia and the United States.

- Obtained an approval from NMPA for the preservative-free unit-dose Diquafosol Sodium Eye Drops for the treatment of dry eye syndromes (such as conjunctival epithelium injury and tear abnormalities) in the PRC.

- A robust intellectual property portfolio of 89 patents (both in certificates and authorisation letters), comprising 68 invention patents (發明專利), 14 utility model patents (實用新型專利) and 7 design patents (外觀專利).

- With a vast distribution network, the Group’s therapeutic products are prescribed in more than 13,500 hospitals and medical providers, coupled with approximately 1,800 pharmaceutical stores, covering major cities, provinces and county cities throughout the PRC.

Essex Bio-Technology Limited (“Essex” or the “Group”, Stock Code: 1061.HK) today announced the interim results for the six months ended 30 June 2024 (“the period under review”).

The period under review has been marked by significant geopolitical events, including ongoing conflicts between Russia and Ukraine, Israel and Hamas and the bearish capital market. These events, coupled with internal reforms and regulatory changes in the PRC, have created a challenging backdrop for business operating in the region.

Despite these headwinds, the Group has demonstrated resilience and adaptability. We have been able to deliver satisfactory operating results while prudently managing our cash resources. Our focus on research & development has yielded a promising pipeline of products that are poised to drive future growth and sustainability.

Navigating a Challenging Market: Group’s Resilience & Satisfactory Results

During the period under review, the Group’s revenue is chiefly derived from its operations in the PRC and denominated in Renminbi. The Group achieved a consolidated revenue of approximately HK$ 811.6 million, and net profit of HK$ 157.44 million, a decrease of 9.8% and 7.3% respectively as compared to the same period last year.

The Group’s net profit margin was however improved to 19.4% from 18.9% in 2023 and basic earnings per share of HK27.74 cents.

As of 30 June 2024, the Group recorded cash and cash equivalents of approximately HK$ 598.4 million (31 December 2023: approximately HK$ 509.8 million). The Board is pleased to propose an interim dividend of HK$6.0 cents (for the six months ended 30 June 2023: HK$4.5 cents) per ordinary share for the six months ended 30 June 2024, higher rewards to shareholders.

On 31 July 2024, the Group repaid the outstanding principal amount of the convertible loan in full of HK$150.0 million, together with the accrued interest and the make whole premium, to International Finance Corporation.

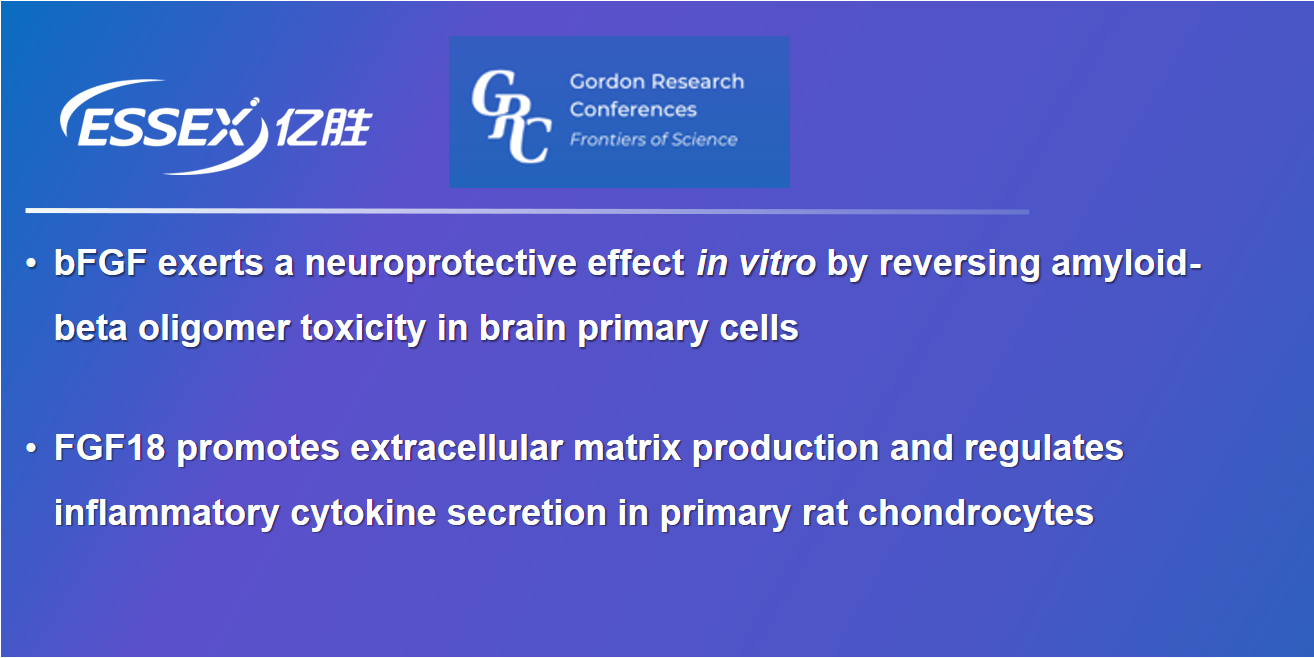

Currently, the Group has 6 self-developed and manufactured commercialized biologics (collectively referred to as the “bFGF Series”) that are marketed and sold in the PRC, and 3 of them were approved by NMPA as National Class I new drug. The combined turnover of the bFGF Series represented about 86.4% of the Group’s total turnover for the period. Besides, the Group have a portfolio of commercialized preservative-free unit-dose eye drops and 2 oral care products, as well as a range of Ophthalmology and Surgical products and medical devices to complement the Group’s therapeutics business.

The Group’s turnover is primarily made up of Ophthalmology and Surgical (wound care and healing). For the six months ended 30 June 2024, Ophthalmology contributed approximately HK$ 375.5 million to the Group’s turnover, while Surgical recorded a total turnover of approximately HK$436.1 million, representing about 46.3% and 53.7% of the Group’s total turnover, respectively. The core products that are current growth drivers under each segment are:

- Ophthalmology – Beifushu® series (Beifushu® eye drops, Beifushu® eye gel and Beifushu® unit-dose eye drops), Tobramycin Eye Drops, Levofloxacin Eye Drops, Sodium Hyaluronate Eye Drops and 適麗順® (Iodized Lecithin Capsules); and

- Surgical (wound care and healing) – Beifuji® series (Beifuji® spray, Beifuji® lyophilised powder and Beifuxin® gel), Carisolv® dental caries removal gel, 伢典醫生® (Dr. YaDian) mouth wash, 伊血安顆粒 (Yi Xue An Granules) and PELNACTM® collagen-based artificial dermis.

Capacity Expansion and New Product Approved

During the period under review, the planned capacity expansion has advanced steadily. The Group is in the process of appointing a new main contractor for the second factory in the PRC, with the completion targeted in 2025.

Research and development (“R&D”) innovation continues to progress and advance smoothly. In August 2024, the Group obtained an approval from NMPA for the registration and commercialisation of the preservative-free unit-dose Diquafosol Sodium Eye Drops (the “Approved Product”) for the treatment of dry eye syndromes (such as conjunctival epithelium injury and tear abnormalities) in the PRC.

The Approved Product is a preservative-free unit-dose eye drops containing 3% (0.4ml:12mg) diquafosol sodium. It is the Group's 6th preservative-free unit-dose eye drops product. The other 5 preservative-free unit-dose eye drops products are Tobramycin Eye Drops, Levofloxacin Eye Drops, Sodium Hyaluronate Eye Drops, Beifushu (rb-bFGF) Eye Drops and Moxifloxacin Hydrochloride Eye Drops. The addition of the preservative-free unit-dose Diquafosol Sodium Eye Drops will further enrich the Group’s ophthalmic product portfolio and would strengthen its ophthalmology segment of market positioning.

The Group further undertakes the promotion and selling of a range of products and medical devices to complement the Group’s therapeutics business of Ophthalmology and Surgical, including 伊血安顆粒 (Yi Xue An Granules), Soft Hydrophilic Contact Lens, Foldable Capsular Vitreous Body, Portable Ultraviolet Phototherapy Devices, PELNACTM® collagen-based artificial dermis, Osteopore’s innovative oral and maxillofacial products in Singapore, SCALGENTM® double-layered artificial dermis and other medical devices for myopia control and prevention such as eye-protection lamp and Seewant defocus customised glasses.

Entrenched Market Access Capability

As of 30 June 2024, the Group maintains a network of 43 regional sales offices in the PRC with more than 1,280 sales and marketing representatives. With a vast distribution network, the Group’s products are prescribed in more than 13,500 hospitals and medical providers, coupled with approximately 1,800 pharmaceutical stores, covering major cities, provinces and county cities throughout the PRC. Building on its Singapore base, the Group has been gaining good traction expanding its market reach into Southeast Asia (SEA) since 2020.

To sustainably grow its current and future product offerings, the Group has relentlessly invested in enhancing competitiveness, expanding its customer base, executing clinical observation programmes for additional indications, targeting lower-tier Chinese cities, fostering complementary sales channels, and leveraging health tech e-platforms to strengthen engagement with medical professionals and patients.

Clear 5-Year Roadmap to Enhance Leadership in Ophthalmic Solutions

During the period under review, the Group remains focused on executing its 5-year (2021 to 2025) R&D development plan. As at the date of this announcement, there are 16 R&D programmes in the pre-clinical to clinical stage, out of which the following 4 ophthalmology programmes are targeted as mid-term growth drivers:

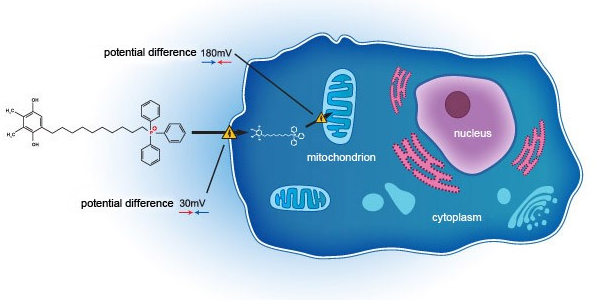

- EB11-18136P: SkQ1 eye drops, second phase 3 clinical trial (US FDA) (VISTA-2) topline data released on 24 February 2021. The continuation of the VISTA program is subject to the completion of the transfer of chemistry, manufacturing and controls (CMC), know-how and intellectual property rights relating to SKQ1 from Mitotech, following the acquisition on 13 Oct 2022.

- EB11-15120P: Azithromycin eye drops, ongoing review by external key opinion leaders (National Medical Products Administration (“NMPA”) in the PRC)

- EB12-20145P: Bevacizumab intravitreal injection for wet-AMD, phase 3 clinical trial (US FDA, European Medicines Agency, Therapeutic Goods Administration and NMPA in the PRC)

- EB11-21148P: Cyclosporine eye drops, phase 2 clinical trial (NMPA in the PRC)

The Group holds a total of 89 patents (certificates or authorisation letters), comprising 68 invention patents (發明專利), 14 utility model patents (實用新型專利) and 7 design patents (外觀專利). The Group currently has multiple R&D sites located in Zhuhai (PRC), Boston (USA), London (UK) and Singapore. These sites support our efforts to develop new therapeutics and recruit global talent.

Honours in Recognition of the Group’s Innovation and Quality.

Zhuhai Essex Bio-Pharmaceutical Company Limited (珠海億勝生物製藥有限公司), a wholly-owned subsidiary of the Group, has been recognised as one of the 2023 top 100 Innovative Companies in Zhuhai (2023年珠海市創新百強企業創新綜合實力100強), and 2023年珠海市創新百強企業經濟貢獻100強 (2023 Top 100 with Economic Contributions in Zhuhai). It has also been recognised as one of the 2023 top 100 chemical pharmaceutical companies in the PRC ( 2023年度TOP100中國化藥企業).

The Group's award-winning Beifushu® has been named one of the Chinese reputable medicine brands in six consecutive years, which is a testament to the industry's recognition of the efficacy and quality of the Group’s flagship biologic drug.

The Group has, once again, been included in 2024 Forbes Asia’s Best Under A Billion list, which a testimony to the Group’s achievements to date.

Mr. Patrick Ngiam, Chairman of Essex, concluded, “Our strong foundation, combined with our ability to navigate challenging conditions, will enable us to continue to deliver value to our shareholders.”

~ End ~

About Essex (1061.HK)

Essex Bio-Technology is a bio-pharmaceutical company that develops, manufactures and commercialises genetically engineered therapeutic b-bFGF, with six commercialised biologics currently marketed in China. Additionally, the Company has a diverse portfolio of commercialised preservative-free unit-dose eye drops, Shilishun(適麗順®)(Iodized Lecithin Capsules) and others, which are principally prescribed for wounds healing and diseases in Ophthalmology and Dermatology.

These products are marketed and sold through approximately 13,500 hospitals, supported by the Company’s 43 regional offices in China. Leveraging its in-house R&D platform in growth factor and antibody technology, Essex Bio-Technology maintains a robust pipeline of projects in various clinical stages, covering a wide range of fields and indications.

These products are marketed and sold through approximately 13,500 hospitals, supported by the Company’s 43 regional offices in China. Leveraging its in-house R&D platform in growth factor and antibody technology, Essex Bio-Technology maintains a robust pipeline of projects in various clinical stages, covering a wide range of fields and indications.

粤公网安备 44049102496184号

粤公网安备 44049102496184号