COMPANY NEWS

Essex Bio-Technology Announces 2021 Financial Results Achieves an increase of 58% in Profit-After-Tax to HK$346.0 million and Turnover Growth of 67.4% to HK$1,637.7 million

2022.03.22

Download

Hong Kong, 22 Mar 2022

Highlights

Highlights

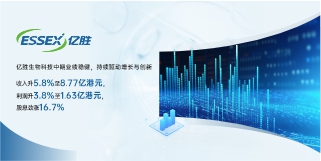

- The group’s turnover surged 67.4% to HK$1,637.7 million, Profit-After-Tax lifted 58% to HK$346.0 million;

- Sales coverage increased to around 10,500 hospitals and 2,110 pharmaceutical stores in the PRC;

- Obtained an approval for the registration and commercialisation of the preservative-free unit-dose Moxifloxacin Hydrochloride Eye Drops in the PRC;

- Significant progress in R&D program, 15 R&D programs in the pre-clinical to clinical stage, out of which 3 ophthalmology programs are in clinical stage as the below:

- SkQ1 eye drops, second phase 3 clinical trial (US FDA) (VISTA-2) topline data released on 24 February 2021;

- Azithromycin eye drops, ongoing review by external key opinion leaders (National Medical Products Administration (“NMPA”) in the PRC);

- Bevacizumab intravitreal injection for wet-AMD, phase 3 clinical trial (US FDA, European Medicines Agency, Therapeutic Goods Administration and NMPA in the PRC);

- Holds a total of 44 patent certificates or authorisation letters: 35 invention patents (發明專利), 4 utility model patents (實用新型專利) and 5 design patents (外觀專利);

- Completed the acquisition of IP rights relating to R&D, production and MAH of Shilishun(適麗順®)(Iodized Lecithin Capsules).

Essex Bio-Technology Ltd (“Essex” or the “Group”, Stock Code: 1061.HK) today announced the annual results for the year ended 31 December 2021.

Significant progression in Financial Performances

Essex achieved significant progression and encouraging performances amid the COVID-19 pandemic and macro uncertainties. For the year ended 31 December 2021, the Group recorded a turnover growth of 67.4% to approximately HK$1,637.7 million as compared to approximately HK$978.1 million in 2020, indicating a strong recovery to the pre-COVID-19 operating level. In tandem with the increase of turnover, the Group achieved an increase of 58% in after-tax profit to approximately HK$346.0 million as compared to approximately HK$218.9 million in 2020.

Turnover of Ophthalmology and Surgical Segments Surged 60.6% and 72.6% respectively

The Group’s turnover is primarily made up from the segments of Ophthalmology and Surgical (wound care and healing). The core products that are of current growth driver under each segment are:

- Ophthalmology – Beifushu series (Beifushu eye drops, Beifushu eye gel and Beifushu unit-dose eye drops), Tobramycin Eye Drops, Levofloxacin Eye Drops, Sodium Hyaluronate Eye Drops, Moxifloxacin Hydrochloride Eye Drops and Shilishun(適麗順®)(Iodized Lecithin Capsules); and

- Surgical (Wound care and healing) – Beifuji series (Beifuji spray, Beifuji lyophilised powder and Beifuxin gel), Carisolv® dental caries removal gel, 伢典醫生 (Dr. YaDian) mouth wash and 伊血安顆粒 (Yi Xue An Granules).

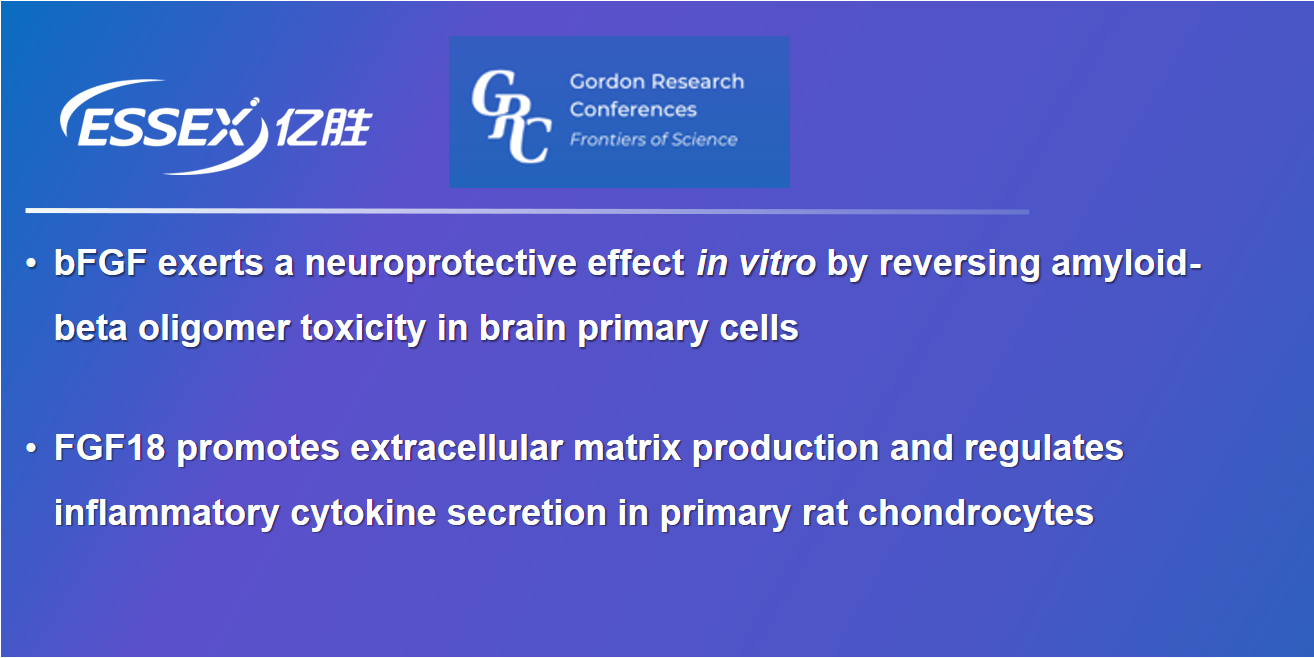

The sectoral turnover of Ophthalmology and Surgical is approximately 41.1% and 58.9% of the Group’s turnover, respectively. The combined turnover of the Group’s flagship biologics, Beifushu series and Beifuji series, the basic fibroblast growth factor (bFGF) based biologic drugs, represented about 84.3% of the Group’s total turnover, of which Beifushu series and Beifuji series accounted for 26.1% and 58.2% of the Group’s turnover, respectively. The remaining 15.7% of the Group’s turnover is mainly contributed from sales of Tobramycin Eye Drops, Levofloxacin Eye Drops, Sodium Hyaluronate Eye Drops, Moxifloxacin Hydrochloride Eye Drops, Shilishun(適麗順®)(Iodized Lecithin Capsules), Carisolv® dental caries removal gel, 伢典醫生 (Dr. YaDian) mouth wash and 伊血安顆粒 (Yi Xue An Granules), collectively. Ophthalmology segment contributed approximately HK$673.3 million to the Group’s turnover for the year ended 31 December 2021, representing an increase of 60.6% as compared to approximately HK$419.2 million in 2020. Surgical segment recorded a total turnover of approximately HK$964.4 million for the year ended 31 December 2021, representing an increase of 72.6% as compared to approximately HK$558.9 million in 2020. The increase was attributable to the resumption of clinical operations in hospitals to normalcy in the PRC and the expansion of sales.

The selling of Xalatan® Eye Drops and Xalacom® Eye Drops would be discontinued in 2022 that contributed approximately 2% to the Group’s gross profit for the year ended 31 December 2021.

The Board proposed a final dividend of HK$0.055 (2020: HK$0.05) per ordinary share to be approved at the upcoming annual general meeting of the Company.

Mr. Patrick Ngiam, Chairman of Essex, said, “2021 has been a year full of diverse challenges. Our part of the world has been affected by extended lockdowns and border closures under COVID zero regime, even as other regions begun to reopen. Despite yet another difficult year inflicted by the pandemic of COVID-19 on us all, the tenacity, drive and leadership in our DNA was able to deliver greater stakeholder value. The Group has achieved significantly improved financial performances in the financial year ended 31 December 2021. This is a testament that the Group’s business is resilient and was able to recover swiftly to the pre-COVID-19 level after the normalcy of the clinical operations of hospitals resumed in the PRC since September 2020.”

Significant Business Development Activities

The Group is committed to pragmatically investing in new products and technologies to strengthen the Group’s product and R&D pipeline as near to mid-term growth driver in ophthalmology and long-term plan for new therapeutics in oncology. During the year under review, major investments in ophthalmic products are outlined as follows:

Investment in Ophthalmology

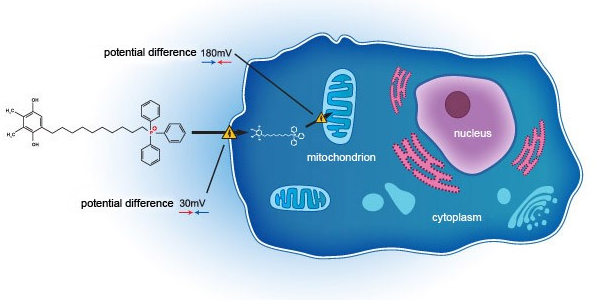

Significant progress for SkQ1’s second phase 3 clinical trial

In 2018, the Group entered into a co-development agreement with Mitotech S.A. (“Mitotech”) and Mitotech LLC for the United States Food and Drug Administration (the “US FDA”) phase 3 clinical trial of an ophthalmic solution containing SkQ1 for dry eye disease. As disclosed in the announcement of the Company dated 24 February 2021, positive outcome was achieved during second phase 3 clinical trial (VISTA-2). The clinical trial study repeated statistically significant positive results on key predefined secondary end-point (Central Corneal Fluorescein Staining). The Board is enthusiastic about the read-out of clearing of central staining of the cornea (defined as zero staining in central cornea), which reveals the potential of SkQ1 in addressing oxidative stress in dry eye diseases. Following the positive trial outcome of VISTA-2, Mitotech has planned a pivotal trial (VISTA-3), which will commence once Mitotech’s management team has fully assessed there is no potential disruption to trial centres and patient recruitment during the ongoing COVID-19 pandemic. However, recent developments in Ukraine have led to governments and industries reacting to business relationships with Russia in a way that could potentially induce delays in Mitotech’s VISTA clinical trial program.

HLX04-O approved for phase 3 clinical trial

In 2020, the Group entered into a co-development and exclusive license agreement with Shanghai Henlius Biotech, Inc. to co-develop a pharmaceutical product that contains an anti-vascular endothelial growth factor (“anti-VEGF”) as a drug substance, which is intended for the treatment of exudative (wet) age-related macular degeneration (“wet-AMD”). As at the date of 22 March 2022, the recombinant anti-VEGF humanised monoclonal antibody injection HLX04-O (“HLX04-O”) for the treatment of wet-AMD has been approved to commence the phase 3 clinical trial in Australia, the United States, Singapore, Russia, Serbia and European Union countries such as Hungary, Spain, Latvia, the Czech Republic and Poland. Also, the first patient has been dosed in a phase 3 clinical study for HLX04-O for the treatment of wet-AMD in the PRC.

Ophthalmology business is expected to be further strengthened by the acquisition of Shilishun(適麗順®)(Iodized Lecithin Capsules)

The successful acquisition of IP rights relating to R&D, production and MAH of Shilishun(適麗順®)(Iodized Lecithin Capsules) will enable the Group to strengthen its ophthalmology business.

Market Development

Robust Market Access Capability

Over the years, the Group has been relentlessly investing in establishing and strengthening its market access capability. As at 31 December 2021, the Group maintains a network of 43 regional sales offices in the PRC and a total number of about 1,265 sales and marketing representatives, out of which 64% are full-time employees and 36% are on contract basis or from appointed agents.

More Extensive Healthcare Network for Product Prescription

During the year under review, the Group’s therapeutic products are being prescribed in more than 10,500 hospitals and medical providers, coupled with approximately 2,110 pharmaceutical stores, which are mainly located in the major cities, provinces and county cities in the PRC.

Further Investments to Strengthen Competitiveness and Customer Base

For achieving a sustainable traction on growth for currently marketed products as well as for near-term to mid-term new products being commercialised, the Group initiated investments to improve its competitiveness and widen its customer base under the following plans:

- Investing in clinical observation programs for affirming additional clinical indications of its commercialised products;

- Reaching out to market in lower-tier cities;

- Cultivating pharmaceutical stores, where possible, as complementary sales channel; and

- Building on-line platform for medical consultation and e-prescription for patients with chronic diseases under its healthtech initiative.

The Group has initiated its market access expansion to Southeast Asian countries by setting up a base and expanded its presence in Singapore since 2020.

Research and Development

The Group renewed its R&D ’s vision, emphasising the dedication to science and innovation, with a mission to develop therapeutics that would meet unmet clinical and/or commercial needs. The Group concurrently kick-started a 5-year (2021 to 2025) R&D’s development plan to further strengthen its R&D capability and its position in Ophthalmology.

As at 31 December 2021, there are 15 R&D programs in the pre-clinical to clinical stage, out of which 3 ophthalmology programs are in clinical stage. The 3 ophthalmology programs listed below are targeted as mid-term growth driver.

- EB11-18136P: SkQ1 eye drops, second phase 3 clinical trial (US FDA) (VISTA-2) topline data released on 24 February 2021

- EB11-15120P: Azithromycin eye drops, ongoing review by external key opinion leaders (National Medical Products Administration (“NMPA”) in the PRC)

- EB12-20145P: Bevacizumab intravitreal injection for wet-AMD, phase 3 clinical trial (US FDA, European Medicines Agency, Therapeutic Goods Administration and NMPA in the PRC)

As at the date of this announcement, the Group has obtained a total of 44 patent certificates or authorisation letters: 35 invention patents (發明專利), 4 utility model patents (實用新型專利) and 5 design patents (外觀專利).

The Group currently has diversified its R&D resources to multiple research sites in Zhuhai (PRC), Boston (United States), London (United Kingdom) and Singapore which supports not only our pursuit for new therapeutics but also our acquisition of global talent.

Prospects

Looking ahead, the Group will continue to monitor the circumstances under the uncertainty of COVID-19 in 2022. Its strong team spirit and dynamic leadership have provided it with the capacity to navigate these turbulent times, and capture any opportunities in the ever changing world. The Group remains highly dynamic in delivering positive results in the coming year.

“COVID-19 remains a major concern in 2022 globally. We continue to monitor the situation and will take appropriate actions to overcome any unforeseen challenges. Barring the unforeseen circumstance, the Group remains focus on executing its plans and delivering progressive results. I would like to take this opportunity to express my sincere gratitude to all stakeholders, business associates and valued customers for the trust, support and cooperation accorded to us, and each and every member of the Group for their relentless efforts rendered in shaping the Group into being a progressive and promising pharmaceutical player.”, said Mr. Patrick Ngiam.

~ End ~

About Essex Bio-Technology Limited (Stock Code: 1061.HK)

Essex Bio-Technology Limited is a bio-pharmaceutical company that develops, manufactures and commercialises genetically engineered therapeutic rb-bFGF (FGF-2), having six commercialised biologics marketed in China since 1998. Additionally, it has a portfolio of commercialised products of preservative-free unit-dose eye drops and Shilishun(適麗順®)(Iodized Lecithin Capsules) etc.. The products of the Company are principally prescribed for the treatment of wounds healing and diseases in Ophthalmology and Dermatology, which are marketed and sold through approximately 10,500 hospitals and managed directly by its 43 regional sales offices in China. Leveraging on its in-house R&D platform in growth factor and antibody, the Company maintains a pipeline of projects in various clinical stages, covering a wide range of fields and indications.

粤公网安备 44049102496184号

粤公网安备 44049102496184号